💳 Credit Scores Affect Everything: What You Don’t Know Might Hurt You

When people hear the term “credit score”, many instantly think of buying a house or getting a loan. But here’s the thing—your credit score is a lot more powerful (and nosier) than you might think. It sneaks into your life in unexpected ways, affecting whether you can rent an apartment, buy a phone, or even land a job.

In short: your credit score might know more about your future than you do. 🕵️♂️

📊 What’s in a Number?

Let’s break it down. Your credit score is a three-digit number, usually between 300 and 850, that shows how reliable you are with borrowed money.

● Above 750 = Excellent

● 700–749 = Good

● 650–699 = Fair

● 600–649 = Poor

● Below 600 = Uh-oh 😬

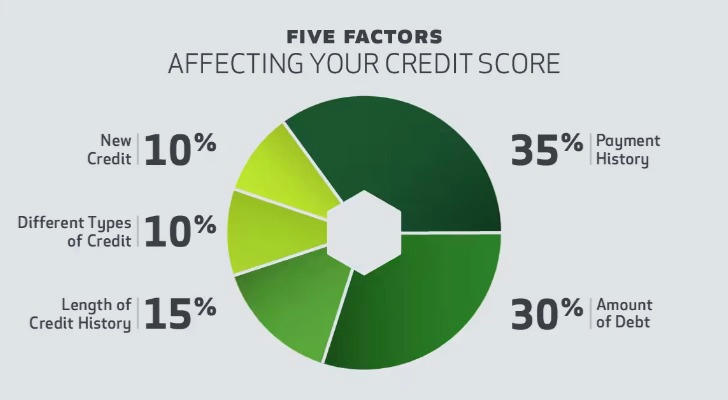

This number is based on:

● Your payment history

● Amounts owed

● Length of credit history

● New credit applications

● Types of credit used

According to Experian, the average FICO score in the U.S. in 2023 was 717, which sounds decent—but averages don’t show the whole story. One missed payment or high credit card balance can drop your score like a rock.

🏠 1. Want to Rent an Apartment? Your Score Might Say No.

You’ve found the perfect place—bright kitchen, quiet neighbors, and a rent you can just afford. But wait… your credit score is 610. The landlord says, “Sorry.”

Yep. In many cities, landlords use credit scores as a filter—and low scores can mean:

● Bigger deposits 💸

● Needing a co-signer 👥

● Or straight-up denial 🚫

🔍 A survey by TransUnion found that 9 out of 10 landlords check credit reports before approving tenants.

So even if you’ve never missed rent in your life, a poor credit score from late student loan payments can block your path to housing.

👔 2. Your Job Application? Credit Checks Happen There Too.

Here’s a surprise: employers may check your credit too.

Especially in jobs that deal with money, sensitive information, or high levels of trust (think banking, government, or management), a poor credit report can raise red flags.

● Employers aren’t checking your score specifically—but your credit report may reflect issues like collections or bankruptcy.

● The concern isn’t just about money; it’s about responsibility and judgment.

📈 According to the National Association of Professional Background Screeners, about 31% of employers include credit checks as part of the hiring process for some roles.

Imagine losing out on a job—not because of your skills, but because of a forgotten bill from three years ago.

💥 Two Pain Points, One Solution: Build It or Break It

Whether you're applying for an apartment or a job, your credit history speaks before you do.

Here’s how to keep it in shape:

✅ Tips to Keep Your Credit Score Healthy

🔹 Pay on time, always.

Even one late payment can drop your score dramatically.

🔹 Keep your credit usage low.

Using more than 30% of your available credit makes lenders nervous.

🔹 Don’t close old accounts.

Longer credit history = better score.

🔹 Limit new credit applications.

Each inquiry can ding your score a little.

🔹 Check your credit reports regularly.

Errors happen! Spot them before they cost you.

🧠 Pro tip: You’re entitled to one report per year from each of the three major credit bureaus: Experian, TransUnion, and Equifax.

🎯 Real Life Example: Two Renters, Two Outcomes

Ashley has a credit score of 765. She applies for a downtown apartment and gets approved within a day, with just one month’s deposit.

Jake has a score of 610, caused by overdue medical bills and a maxed-out card. He’s asked for a co-signer and a two-month deposit—and the landlord hesitates.

Same income. Same job. Totally different experiences—all because of three little numbers.

🧭 Why This Matters More Than Ever

With rent prices rising, competition for jobs increasing, and economic uncertainty in the air, your credit score has gone from being a number in the background to a key part of your adult resume.

It’s not just about borrowing money anymore. It’s about being seen as trustworthy, responsible, and financially aware.

📌 Final Thoughts

Credit scores aren’t the enemy—but they can become one if you ignore them. The good news? They’re not set in stone. With consistent habits and some patience, almost anyone can improve their score.

So whether you're aiming for a new home, your dream job, or just peace of mind, it might be time to treat your credit score like your financial reputation—because that’s exactly what it is.

📍 Remember: The higher your credit score, the fewer the obstacles between you and the life you want.